All from Crude Oil

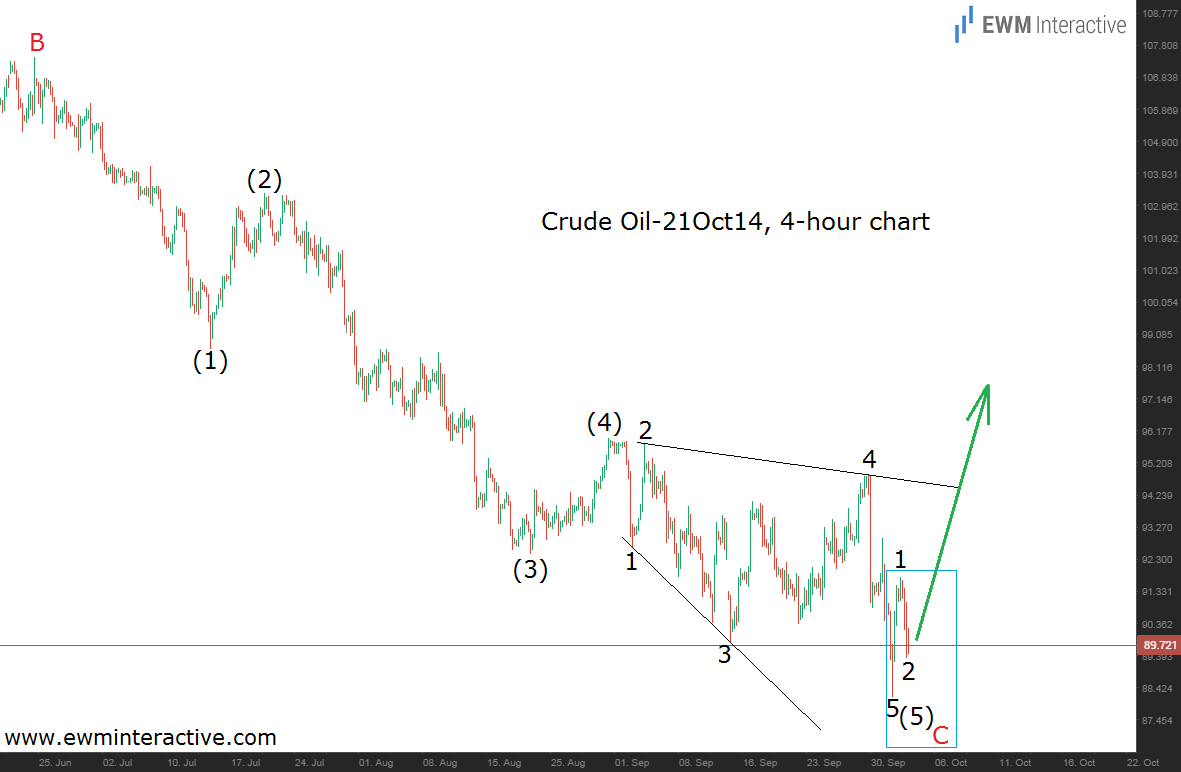

Crude Oil with an Extremely Rare Pattern

The last time we talked about crude oil was on 12th September in an article, called “A Major Bottom for Crude Oil Prices?”, where…

Crude Oil with an Extremely Rare Pattern

The last time we talked about crude oil was on 12th September in an article, called “A Major Bottom…

A Major Bottom for Crude Oil Prices?

Crude oil is trading more than $20 below the 2013 highs. Should we expect more weakness? Traders and investors may be willing to find…

A Major Bottom for Crude Oil Prices?

Crude oil is trading more than $20 below the 2013 highs. Should we expect more weakness? Traders and investors…

Natural Gas prices broke trendline

Natural gas prices have been declining steadily, despite all the tension between Russia and Ukraine. For many fundamental analysts this might have come as…

Natural Gas prices broke trendline

Natural gas prices have been declining steadily, despite all the tension between Russia and Ukraine. For many fundamental analysts…

Sugar to head towards 20 soon

Sugar has been declining for quite some time now, falling down from 18.80 to 16.86. If we take a look at this sell-off, we…

Sugar to head towards 20 soon

Sugar has been declining for quite some time now, falling down from 18.80 to 16.86. If we take a…

Crude oil, the long-term view

Crude oil is probably the raw material, the world economy depends the most on. That is why we think its price trends deserve to be…

Crude oil, the long-term view

Crude oil is probably the raw material, the world economy depends the most on. That is why we think its…

Sugar with some interesting opportunities

It was April 23rd, when we showed you the following chart, stating that sugar has already drawn a perfect 5-3 Elliott Wave cycle and it…

Sugar with some interesting opportunities

It was April 23rd, when we showed you the following chart, stating that sugar has already drawn a perfect…

Coffee with the perfect development

On the 1st of May we showed a forecast of coffee, suggesting that its price could go down significantly: “we should expect a three-wave…

Coffee with the perfect development

On the 1st of May we showed a forecast of coffee, suggesting that its price could go down significantly:…

Sugar – bulls’ favourite candy

On the 4-hour chart of sugar’s June futures we can see a five-wave impulse to the upside, followed by a zig-zag correction. Wave C of…

Sugar – bulls’ favourite candy

On the 4-hour chart of sugar’s June futures we can see a five-wave impulse to the upside, followed by a…

Crude Oil according to plan

On April 8th we published an analysis on crude oil, in which we were expecting a decline soon. We were preparing for a sell-off, because…

Crude Oil according to plan

On April 8th we published an analysis on crude oil, in which we were expecting a decline soon. We were…

Natural Gas down despite Russia-Ukraine. Why?

The tension between Russia and Ukraine has been in the media for quite some time now. Usually when there is a conflict or some…

Natural Gas down despite Russia-Ukraine. Why?

The tension between Russia and Ukraine has been in the media for quite some time now. Usually when there…

Coffee is not so strong

Coffee has been in a strong uptrend during the last five months, climbing up from 100 to above 217, which was quite impressive. But…

Coffee is not so strong

Coffee has been in a strong uptrend during the last five months, climbing up from 100 to above 217,…

Sugar, so far so good

A month ago, on March 23rd, we showed you this chart from our forecast on sugar: As the chart shows, we were expecting wave B…

Sugar, so far so good

A month ago, on March 23rd, we showed you this chart from our forecast on sugar: As the chart shows,…

Crude Oil still corrective

In our previous analysis on crude oil we stated that prices could go higher, if the market decides to make wave (2)/B more complicated. On…

Crude Oil still corrective

In our previous analysis on crude oil we stated that prices could go higher, if the market decides to make…

Sugar trading opportunities

Sugar could provide two opportunities. The fist one is to wait until wave “B red” is finished and sell in order to catch wave…

Sugar trading opportunities

Sugar could provide two opportunities. The fist one is to wait until wave “B red” is finished and sell…

Crude Oil still bearish

Crude oil fell in five waves from 105.20 to 97 dollars. This whole decline happened, despite the Russia-Ukraine conflict and the expectations that it…

Crude Oil still bearish

Crude oil fell in five waves from 105.20 to 97 dollars. This whole decline happened, despite the Russia-Ukraine conflict…

CRB index. Where commodities are heading?

CRB index is an index that measures the overall direction of commodity sectors. The CRB index was designed to isolate and reveal the directional…

CRB index. Where commodities are heading?

CRB index is an index that measures the overall direction of commodity sectors. The CRB index was designed to…

Crude Oil went well

In our analysis from March 16th we were waiting for a decline in wave 5. That forecast of crude oil went well and on…

Crude Oil went well

In our analysis from March 16th we were waiting for a decline in wave 5. That forecast of crude…

Cocoa could fall, at least temporary

Cocoa has been in a strong uptrend for over a year. What is more important is that this rise is in five waves. So,…

Cocoa could fall, at least temporary

Cocoa has been in a strong uptrend for over a year. What is more important is that this rise…

Crude Oil outlook update

Our crude oil outlook update will start with our analysis from February 25th, because you should know how our bigger picture scenario looks like. As…

Crude Oil outlook update

Our crude oil outlook update will start with our analysis from February 25th, because you should know how our bigger…

Copper measures the strength of the economy

Industrial copper is a leading indicator of the economy’s health and moreover the strength of the world’s industry. The uptrend in copper coincides with…

Copper measures the strength of the economy

Industrial copper is a leading indicator of the economy’s health and moreover the strength of the world’s industry. The…

Crude Oil steady as it goes

Crude Oil extended its five-wave decline, dropping by more than 5$, from 105,25 to 100,10, despite the Russia-Ukraine conflict. So, from a fundamental point…

Crude Oil steady as it goes

Crude Oil extended its five-wave decline, dropping by more than 5$, from 105,25 to 100,10, despite the Russia-Ukraine conflict….

Crude Oil’s strength could be deceptive

Crude oil is in its seventh straight week of steady rise, but is it now the time to be a buyer? In order to…

Crude Oil’s strength could be deceptive

Crude oil is in its seventh straight week of steady rise, but is it now the time to be…

Crude Oil big picture

When the Grand Super Cycle (GSC) in crude oil finished his 5th wave in 2008, a sharp and fast decline occurred. Through Elliott Wave…

Crude Oil big picture

When the Grand Super Cycle (GSC) in crude oil finished his 5th wave in 2008, a sharp and fast…

New to Elliott Wave?

Elliott Wave principle offers a completely new understanding of what the nature of the markets is, what drives them and what can be derived from their movement. This course is for those of you, who have been looking for an honest Elliott Wave guide, describing the method’s advantages over other trading tools, but not hiding its weaknesses.

Last year over 60k readers trusted EWM Interactive to help them in their trading decisions.

I’m very happy i discovered your service. Thanks so much and keep up the good work!

– Xavier N.

Just loving your analysis. Thank you so much, really wished you add some more currencies to your list You have a client for life 🙂

– J. Kotzee

I love the way EWM does business: response times & overall friendly demeanor are fantastic… and the prices are very fair. The trade recommendations read like like they come from a seasoned trader that is used to winning. Couldn’t ask for more.

– C. Montgomery

I love the way EWM does business: response times & overall friendly demeanor are fantastic… and the prices are very fair. The trade recommendations read like like they come from a seasoned trader that is used to winning. Couldn’t ask for more.

– C. Montgomery

I’m very happy i discovered your service. Thanks so much and keep up the good work!

– C. Montgomery

Just loving your analysis. Thank you so much, really wished you add some more currencies to your list You have a client for life 🙂

– C. Montgomery

Would you like free analyses?

Subscribe to our newsletter and receive free analyses as soon as we publish plus latest discounts and promotions directly to your inbox. Simply enter your email address below.