The term “Shadow Fed” has recently gained attention in U.S. political and financial media, describing the idea of appointing an unofficial or informal “shadow” Federal Reserve Chair.

Discussions around the “Shadow Fed” have intensified due to President Trump’s consideration of appointing a successor to Federal Reserve Chair Jerome Powell well before Powell’s term concludes.

This move has sparked debates about the potential implications for the Federal Reserve’s independence and the broader financial markets.

U Gen-Z? We’ve got a version of this content just for you. Read it here! ✨

What is the “Shadow Fed”?

The “Shadow Fed” refers to a wild proposal in which President Donald Trump may appoint a “shadow” chair or leader for the Federal Reserve, even while the current chair remains in office.

The idea is that this “shadow” chairperson would serve as an unofficial watchdog or alternative voice on monetary policy, potentially influencing public debate and market expectations, but without any formal authority or legal powers over the Federal Reserve’s decisions.

This can happen if:

- Trump and other members of his administration pressure the Fed in public.

- The government talks early about replacing the Fed Chair with someone more supportive of its views.

- Rumors or comments from likely future Fed leaders start moving financial markets ahead of any official changes.

Normally, the Federal Reserve (or “Fed”) is supposed to act independently and base its decisions on what is best for the economy, not on politics.,

This means it is supposed to make decisions without being influenced by the President or Congress.

However, in recent months, there has been growing speculation that the White House is trying to influence the Fed’s direction by making public statements about who should be the next Chair and by signaling its preferences much earlier than usual.

The idea of a “shadow” chair is unprecedented and has raised concerns about the independence of the Federal Reserve.

Market participants worry that such a move could undermine confidence in U.S. monetary policy and create confusion or volatility in financial markets.

Why does Fed independence matter?

The Fed’s job is to:

- Help people find jobs: The Fed tries to make sure there are plenty of jobs for people who want to work.

- Keep prices steady: The Fed tries to stop prices from rising too fast (inflation) or falling too much (deflation), so your money keeps its value.

These two objectives are known as the Fed’s “dual mandate.”

The Fed aims to achieve maximum employment, meaning the highest level of employment the economy can sustain without causing inflation, and stable prices, typically interpreted as a 2% inflation rate over the longer run.

To do this well, the Fed sometimes needs to make hard decisions that are unpopular, like raising interest rates. If people think the Fed is only doing what politicians want, they lose trust that it can control inflation and protect the economy.

History shows that when central banks let politicians influence them, inflation usually gets worse, and the economy becomes less stable.

Why are people talking about the “Shadow Fed” now?

After the 2024 presidential election, Donald Trump returned to the White House.

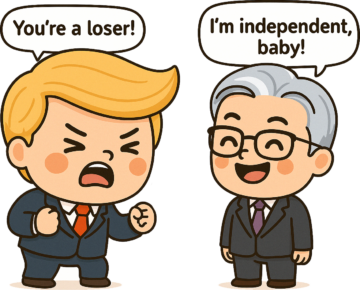

He is known for pushing hard for economic growth and is sometimes critical of the Federal Reserve when it does not agree with his policies.

(During Trump’s first term, he often publicly criticized the Fed Chair, Jerome Powell, for not lowering interest rates as much as he wanted.)

The President has argued that lower rates would help the economy grow faster and make the U.S. more competitive, especially given new tariffs and trade policies.

The Federal Reserve, still led by Powell, has kept interest rates higher than the Trump administration would like, saying it wants to be sure inflation is under control before making any cuts.

Predictably, President Trump and his team have criticized Jerome Powell, calling him “a major loser” for not cutting interest rates enough.

Just last Thursday, Trump publicly called Powell a “numbskull,” asserted that a 2% rate cut would save $600 billion annually in government debt service costs, and said he “may have to force something” if the Fed does not act.

With Powell’s term as chair not ending until May 2026, Trump is reportedly considering appointing a “shadow” Fed chair, an unofficial figure who would act as a public advocate for the administration’s preferred monetary policy, particularly lower rates, and potentially serve as Powell’s successor.

Fun fact: Trump actually hired Powell in 2018, and the Senate basically gave him a standing ovation with 84 (out of 100) votes. Then they gave him an encore in 2022, reconfirming him for another four-year term by an 80-19 vote. While Powell’s current “Chair” gig runs until May 2026, his broader gig as a Board member lasts until January 2028. So even if you boot him from the top seat, he’ll still be lurking in the boardroom, sipping coffee and raising an eyebrow.

Who are the leading candidates being considered for Fed Chair?

If Trump’s been browsing LinkedIn for a new Fed Chair, who’s making his shortlist? Meet the candidates:

Scott Bessent

Scott Bessent is currently the U.S. Treasury Secretary. Before this, he was a successful hedge fund manager and founded his own investment firm, Key Square Group, a global macro hedge fund.

He told Barron’s in 2024 that, “You could do the earliest Fed nomination and create a shadow Fed chair. And based on the concept of forward guidance, no one is really going to care what Jerome Powell has to say anymore.” Savage.

But he said that before he became Treasury Secretary, and now that he and Powell supposedly have breakfast weekly, maybe they’ve become BFFs.

Views and Style:

- Bessent believes in using communication to guide markets.

- He has defended careful government spending but is seen as practical and open to cutting interest rates if it helps the economy.

- Bessent supports cryptocurrencies and gold.

Concerns:

Many experts worry that because Bessent is very close to the President and comes directly from the Treasury, his appointment could make the Fed appear political instead of independent.

Kevin Warsh

Kevin Warsh is a former Federal Reserve Governor who served from 2006 to 2011, including during the 2008 financial crisis. Since then, he has worked in academia at Stanford University and the Hoover Institution.

Wall Street loves this guy, and so does Trump, apparently. He was a leading contender for Treasury Secretary, but Scott Bessent ultimately got the job.

Views and Style:

- Warsh has been critical of past Fed policies that made borrowing money too easy, arguing that such policies can create bubbles in the market.

- He prefers a “rules-based” approach, focusing on clear, predictable guidelines.

- Warsh is known for believing that inflation is mainly the result of central bank and government actions, not outside factors.

- He strongly supports Fed independence and says that monetary policy should be based on data, not politics.

Concerns:

- He’s known to be hawkish. While favored by some in the Trump administration, Warsh’s views might actually lead him to keep interest rates higher for longer if inflation remains a problem, which is not what Trump wants.

Spock

Spock from Star Trek would be an excellent choice.

His commitment to rational decision-making and ethical conduct would help maintain public trust in the Federal Reserve, while his experience as a science officer demonstrates his capacity to handle vast amounts of data and make sound judgments under uncertainty.

Too bad he’s a fictional character. So we’re stuck with the first two dudes for now.

Comparison: Scott Bessent vs. Kevin Warsh

| Feature | Scott Bessent | Kevin Warsh |

|---|---|---|

| Current Role | U.S. Treasury Secretary | Former Federal Reserve Governor, Stanford academic |

| Background | Hedge fund manager, economic advisor to Trump | Served during 2008 crisis, experience in market turmoil |

| Policy Approach | Practical, open to rate cuts, uses communication | Rules-based, strict on inflation, data-focused |

| View on Independence | Concerns about political ties if appointed | Strong advocate for Fed independence |

| Relationship with President | Very close, current economic advisor and cabinet member | Supported by Trump, but more independent in views |

| Digital Assets | Pro-crypto, pro-gold, against a U.S. CBDC | Not as focused on crypto or gold |

| Market Perception | Might reassure markets due to expertise, but seen as political | Viewed as experienced, may surprise with hawkish (strict) policies |

| Main Concern | Seen as blurring lines between government and Fed | May be less dovish than administration expects |

Other Potential Candidates

- Kevin Hassett

Currently, the Director of the National Economic Council. His monetary policy stance is less clear, but he is a seasoned economic adviser with experience in both the administration and academia. - Christopher Waller

A current Federal Reserve Governor, Waller is considered more dovish and may align with Trump’s calls for rate cuts. Some analysts, including Deutsche Bank, believe Waller could have a strong chance due to his recent policy positions and internal Fed experience. - David Malpass

The former World Bank president is occasionally mentioned as a possible contender, though he appears less prominent than Bessent, Warsh, Hassett, or Waller.

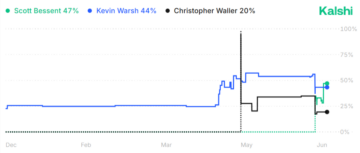

Betting Market Predictions

Kalshi, a prediction market platform where you can trade on the outcomes of real-world events, currently has Scott Bessent in the lead with a 47% chance, while Kevin Warsh not trailing far behind at 44%.

How will the financial market react if the Fed seems politicized?

The existence of a shadow chair could increase uncertainty and volatility in financial markets, as traders and investors might receive conflicting signals from both the official Fed chair and the shadow chair.

If investors think the Fed is being influenced by politics instead of economic data, this can lead to:

- U.S. Dollar: Market participants might lose trust in the dollar, causing it to drop in value against other currencies.

- Stock Market: Stocks may go up at first if rates drop, but long-term worries about inflation and instability could cause big swings and lower prices over time.

- Bonds: Government and corporate bonds could become more unpredictable, with long-term interest rates rising if investors expect more inflation.

- Commodities and Gold: These may go up because investors often use them as protection against inflation and a weak dollar.

- Bitcoin and Crypto: Cryptocurrencies might become more popular as alternatives, especially if new Fed leaders support crypto.

Summary: How the “Shadow Fed” Could Affect Markets

| Asset Class | Likely Impact | Main Reason Why |

|---|---|---|

| U.S. Dollar | Weaker, more volatile | Loss of confidence, inflation |

| Equities (stocks) | Mixed, more volatile | Short-term boost, long-term risk |

| Bonds | More volatile, yields could rise | Inflation fears |

| Commodities & Gold | Likely higher | Inflation hedge, weak dollar |

| Bitcoin/Crypto | Could rise, volatile | Alternative to dollar, policy changes |

Why should forex traders care?

As a forex trader, you should closely watch leadership changes at the Federal Reserve because its policies have a huge impact on the U.S. dollar and other currencies.

Here is why the “Shadow Fed” discussion is important:

- Dollar volatility: If the Fed is seen as losing independence, you could see increased volatility in the U.S. dollar. Unpredictable or politically motivated moves may cause sharp drops or wild swings.

- Interest rate surprises: Political influence could mean more sudden changes in interest rate policy. Since currency prices react quickly to interest rate news, surprises can lead to big moves in currency pairs.

- Inflation impact: If markets expect more inflation because of a politicized Fed, the dollar could weaken further. This would affect all USD pairs.

- Global ripple effects: Other countries’ central banks may react to U.S. decisions, causing ripple effects across global forex markets. You need to watch how the Shadow Fed debate affects not just the dollar, but the euro, yen, pound, and emerging market currencies.

- Safe-haven flows: If market participants get nervous about the U.S. dollar, they may rush into safe-haven currencies (like the Swiss franc or Japanese yen) or into gold and crypto.

As you can see, uncertainty about Fed independence increases forex volatility and can create both risks and opportunities for traders.

How can you spot if the “Shadow Fed” is happening?

How do we know if the idea of a “Shadow Fed” chair is moving from speculation to a serious topic of debate?

Warning signs include:

- The President or advisors are talking publicly about replacing the Fed Chair or criticizing the Fed’s choices.

- Unusually early or political decisions about who will be the next Fed Chair.

- The Fed is becoming less open or clear in its public communications.

- Financial markets (stocks, bonds, gold, currencies) are becoming more volatile as folks react to uncertainty.

What does JPow think about all this?

If Jerome Powell were asked about the “Shadow Fed” concept, he’d likely be annoyed on the inside, but on the outside, respond by reaffirming the Federal Reserve’s independence and its commitment to making policy decisions based on data, rather than external political pressure.

Given his past public remarks and the Fed’s tradition, Powell would probably avoid directly addressing the legitimacy or impact of a “shadow” chair.

Instead, he’d (annoyingly) remind (for the bajillionth time) everyone that the Fed is a non-political institution and that official monetary policy decisions are made collectively by the Federal Open Market Committee (FOMC), which requires majority support and can’t be swayed by unofficial appointees or external voices.