The FOMC maintained its benchmark interest rate at 4.25-4.50% for the fourth consecutive meeting while revising economic projections lower for growth and higher for inflation, signaling a more cautious stance on monetary easing.

Key Takeaways from the June FOMC Statement

- Interest rates held steady at 4.25-4.50% for fourth consecutive meeting as expected

- Economic growth downgraded with 2025 GDP forecast revised down to 1.4% from March’s 1.7% projection

- Inflation outlook worsened as 2025 PCE inflation forecast increased to 3.1% from 2.8%, reflecting persistent price pressures

- Unemployment projections raised slightly to 4.5% for year-end 2025 from previous 4.4% estimate

- Uncertainty acknowledged but diminished with statement noting economic uncertainty has “diminished but remains elevated” compared to previous “increased further”

- Tariff concerns persist as Powell highlighted that many firms expect to pass “some or all” of tariff effects through to consumers

- Dot plot of interest rate forecasts suggested two 25bp cuts still expected by year-end

Link to official FOMC Statement for June 2025

The quarterly FOMC Economic Projections indicated that policymakers downgraded their 2025 GDP forecast to 1.4% from 1.7% while raising inflation expectations to 3.1% from 2.8%, painting a more challenging stagflation picture ahead.

Still, the dot plot projections of interest rates revealed that committee members are still mostly expecting two rate cuts for the remainder of the year, unchanged from their earlier estimates.

Link to FOMC Economic Projections (June 2025)

During his press conference, Chair Jerome Powell struck a notably cautious tone regarding the timing of potential rate cuts. He emphasized that while the labor market remains solid with unemployment near maximum employment levels, inflation continues running “somewhat above” the Fed’s 2% longer-run target.

Powell highlighted that near-term inflation expectations have moved higher, with tariffs serving as a driving factor. He noted that many businesses expect to pass through “some or all” of tariff costs to consumers, creating additional upward pressure on prices in the coming months.

The Fed chair suggested the central bank is “well positioned to wait before policy adjustments,” indicating officials see limited urgency to begin cutting rates despite signs of economic slowing. The CME FedWatch tool now reflects an 89.7% chance of rates staying unchanged next month, up from the earlier 83.3% likelihood prior to the FOMC announcement.

Link to June 2025 FOMC Press Conference

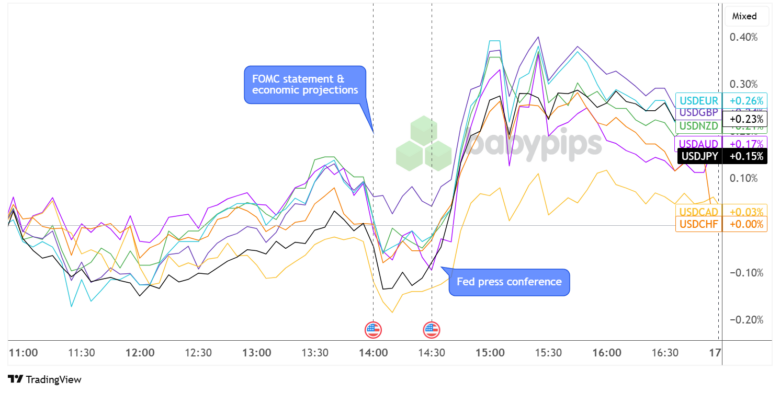

Market Reactions

U.S. Dollar vs. Major Currencies: 5-min

Currency traders appeared to interpret the Fed’s updated projections and Powell’s press conference comments as slightly more hawkish than anticipated. The U.S. dollar, which had been cruising slowly higher leading up to the event, initially had a bearish reaction to the official statement and projections, before rallying across the board during the press conference.

The Greenback’s climb lasted roughly an hour after Powell’s presser before sideways price action ensued, leading USD to close higher versus most of its major counterparts by session’s end. The euro weakened 0.26% against the dollar, while the dollar gained 0.17% versus the Australian dollar and 0.15% against the Japanese yen.

The dollar’s strength likely reflects market recognition that the Fed’s path toward rate cuts may prove more gradual than previously expected. Powell’s comments about waiting “a couple of months” to make “smarter decisions” on policy adjustments appeared to rule out a July rate cut and potentially delayed easing into the fall.