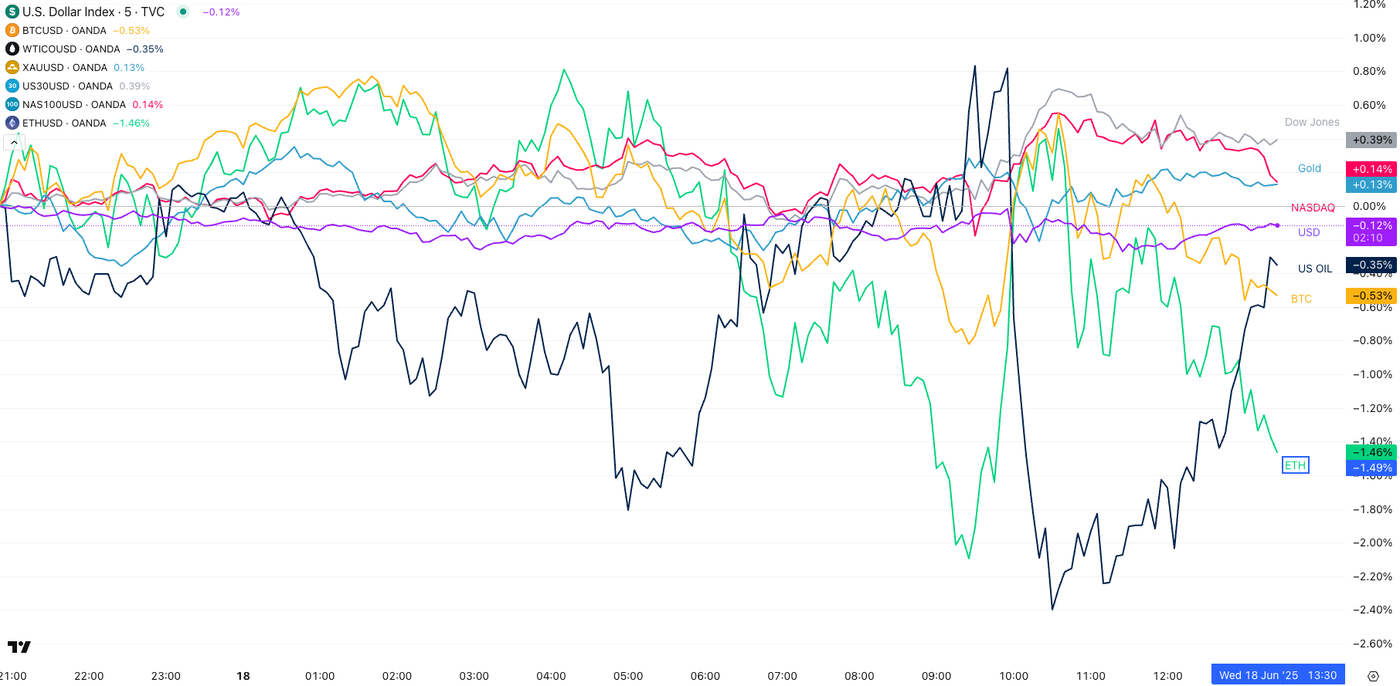

The Fed Funds Rate is unchanged at 4.25% – Oil has been rallying since the release and other assets are still trading at similar levels as before the release

Don’t forget to tune in to FED Chair Powell’s speech starting at 2:30 P.M.

You can access the Powell livestream here.

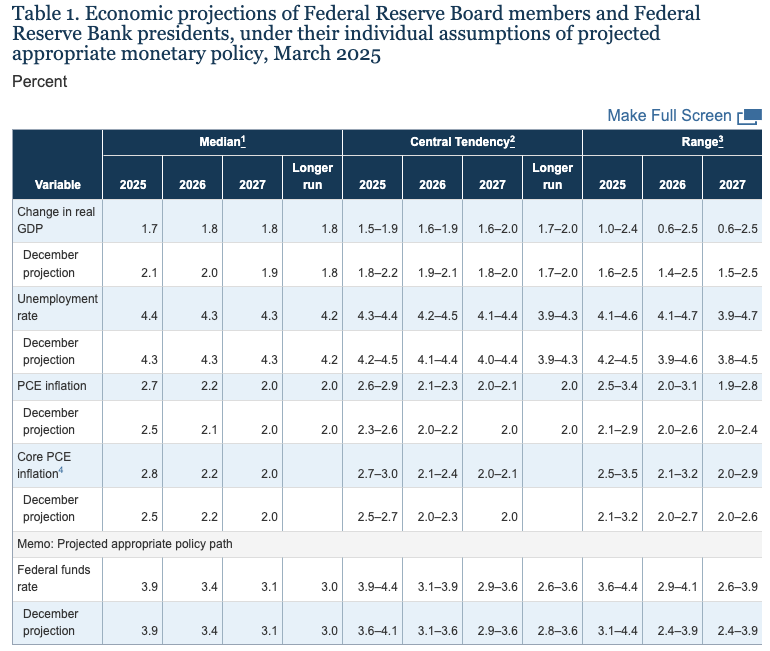

Current Meeting Projections

Last SEP projections

Focus now turns to the 2025 outlook, especially in light of the Fed’s latest Summary of Economic Projections (SEP), which was released during a period of heightened uncertainty around U.S. tariff policy.

Since then, a number of trade agreements have been reached, easing concerns that dominated earlier this year. The so-called “TACO Trump” headlines have rattled markets, and fears of a no-deal scenario are quickly fading into the rearview.

The FED pointed toward a 2.7% year-end PCE Inflation at the last release and some cooling in upcoming years. Core PCE is the FED’s favorite inflation measure as they use this data for that side of their Inflation-Employment Dual Mandate.

Also, look at the Projected FED Funds Rate for the end of 2025, 2026 and the longer-run (“Neutral Rate”).

Any change in this will move markets as cut expectations adjust.

Expect volatile flows – Safe Trades!

Pre-FOMC Cross-Asset Performance

Opinions are the authors’; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2025 OANDA Business Information & Services Inc.