The weekly opened had seen the US Dollar retreat but one ongoing theme is of an overdone USD selling – With war headlines coming out by the minute, the Dollar Index has failed to break new lows and is making its way to the 99.00 pivot zone.

Jerome Powell is currently speaking at the FOMC Rate Decision Press Conference.

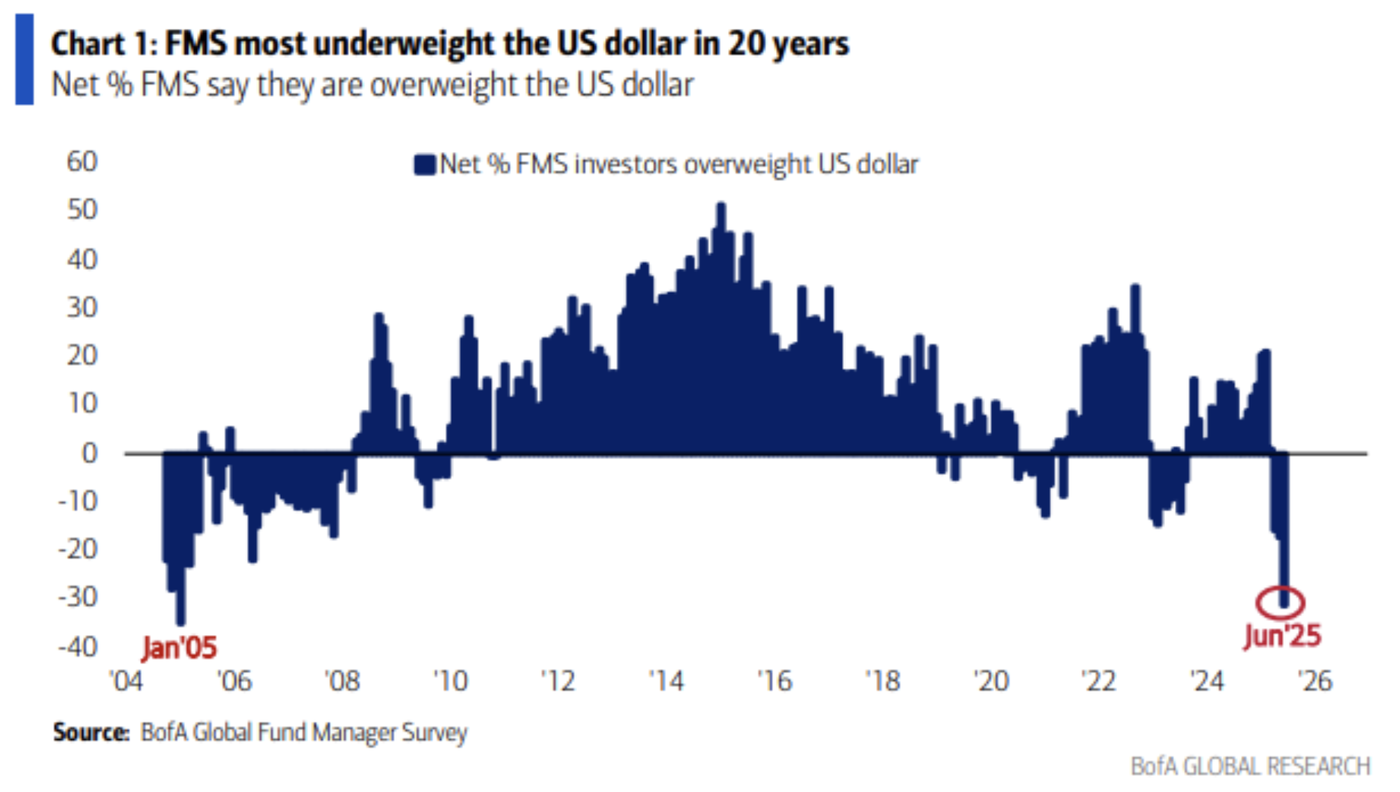

This nice chart offered by Bank of America in their latest Global Funds Manager Survey shows how positioning is changing – Reminder that it’s more an opinion from the Funds Managers than numbers, as global exposure to USD assets is still massive.

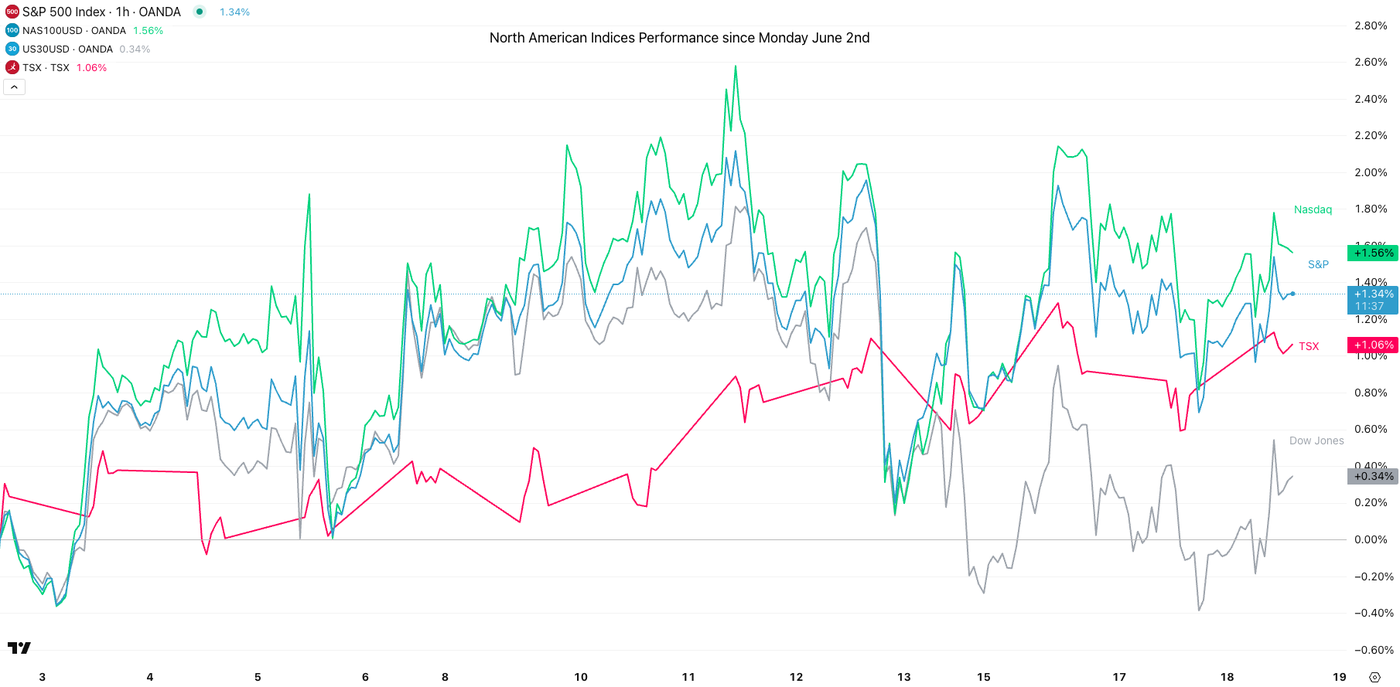

North American Equity Indices Snapshot

North American Indices have held strong and are up since last Monday with the Nasdaq leading, closely followed by the S&P 500.

Anxious market sentiment don’t always transfer to negative Indices performance.

One potential headwind is a potential entry from the US in the Iran-Israel conflict that seems to be closer from materializing.

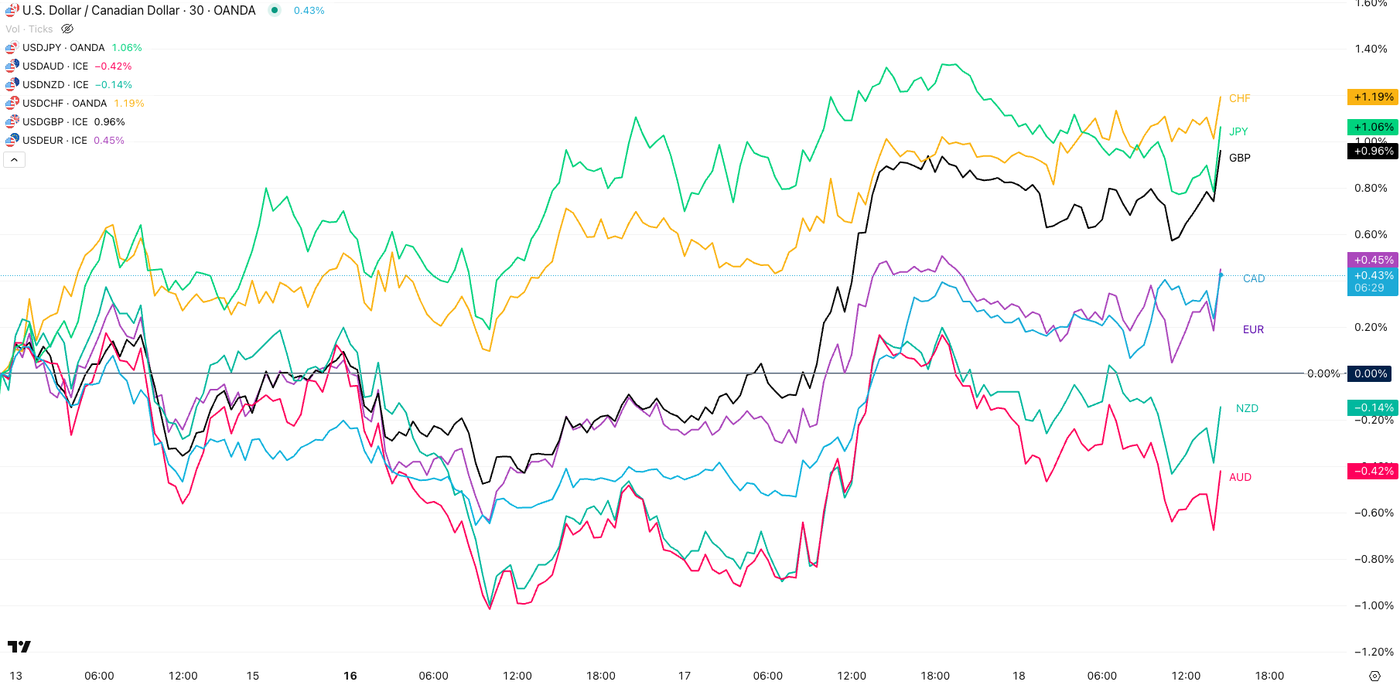

US Dollar Mid-Week Performance vs Majors

The Greenback has held strongly against the GBP and risk-off currencies lagging the most on the week – Another proof of market anxiety not materializing in proper demand for Safe-Haven Assets.

The Dollar has however lagged against the Aussie and the Kiwi for a third straight week as prospects for US-China trade deals enhances the outlook for both exporting nations.

Dollar Index 4H Chart

The DXY is currently close to the 99.00 psychological level as Powell is speaking, and fully corrected from the FOMC Rate Decision downward move.

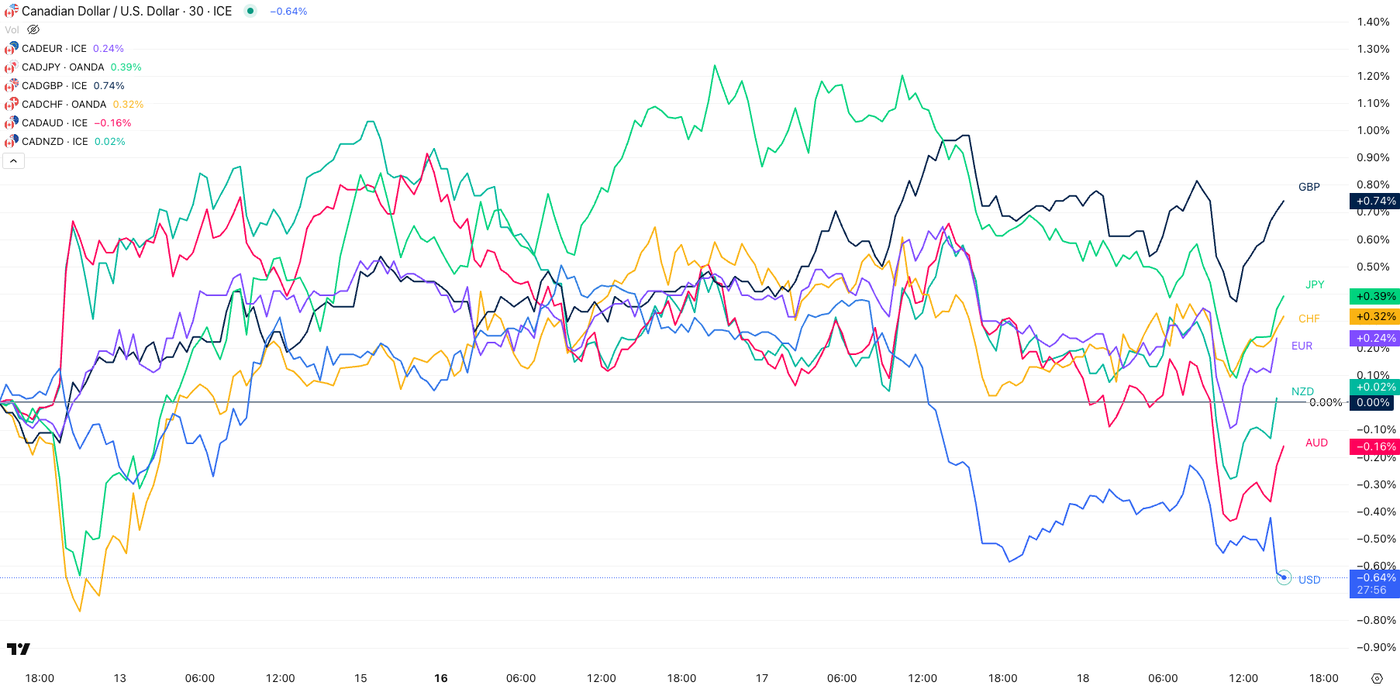

Canadian Dollar Mid-Week Performance vs Majors

The Loonie has held a decent performance throughout the beginning of the week, only lagging against the Australian Dollar and the USD which is getting backed from the geopolitical developments.

Bank of Canada Governor Tiff Macklem spoke this morning about a better outlook on the US Trade conflicts and how important it is to the economy – this hasn’t moved the CAD too much.

Intraday Technical Levels for the USD/CAD

USDCAD is breaking out of the descending channel formed throughout the latter part of May which brought the currency to fresh lows for the year.

Prices are supported by the 4H 50-period moving average and the move up looks like it has the potential to retest the 1.38 Resistance Zone that coincides with the 4H MA 200 (currently standing at 1.3789).

In the meantime, buyers are eyeing the 1.3740 Immediate Resistance zone.

Seller would be looking to re-enter the channel, a move that can only be done by re-crossing the MA 50 standing at 1.3650.

US and Canada Economic Calendar for the Rest of the Week

The rest of the week will focus mostly on Canadian data, with the highest-tier data being the Canadian Retail Sales, coming up on Friday with +0.5% m/m expected.

Safe Trades!

Opinions are the authors’; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2025 OANDA Business Information & Services Inc.