Log in to today’s North American session Recap for June 18

Today’s session was filled with headlines surrounding the ongoing Iran-Israel conflict, but markets have shown limited reaction—at least for now.

One potential trigger for broader risk-off sentiment remains the possibility of direct U.S. involvement, which appears increasingly likely.

President Trump, true to form, has remained characteristically vague on the matter.

On the sidenote, markets have been cut short from their volatility despite a well-anticipated FED Meeting and the release of the Summary of Economic Projections.

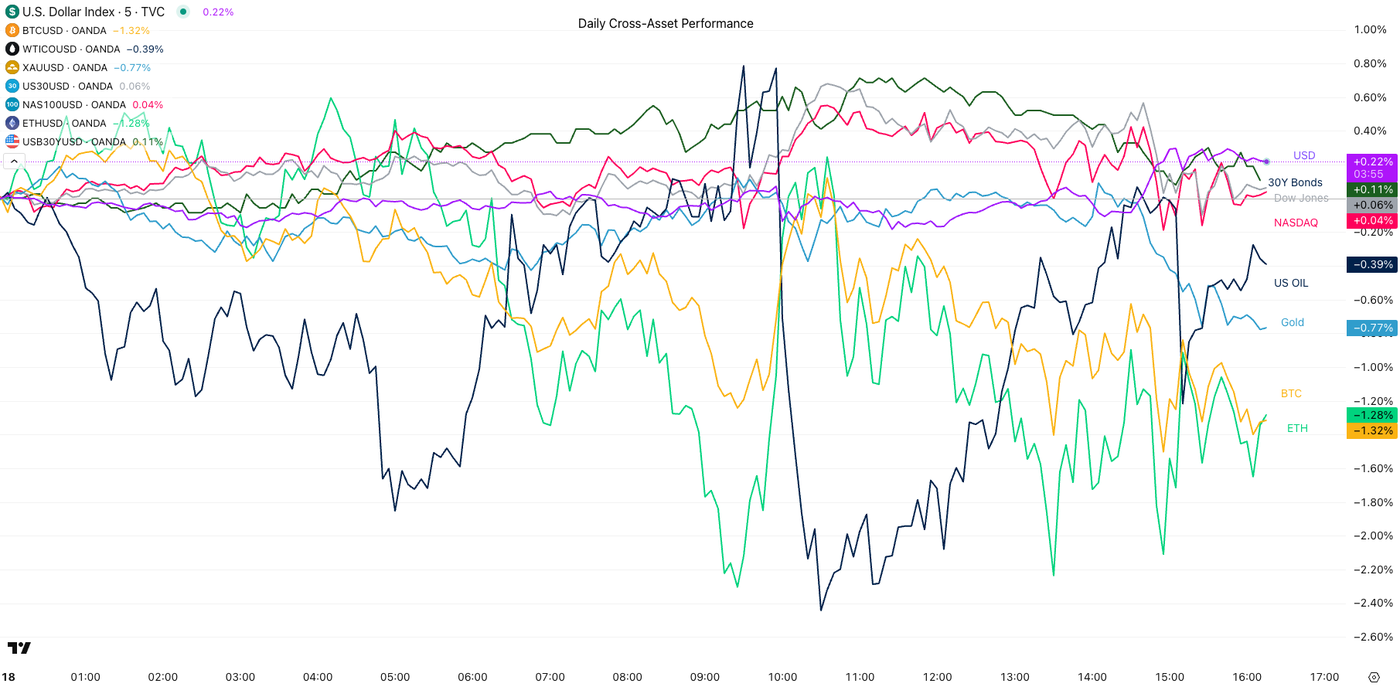

Only cryptocurrencies have corrected amid some continuation of profit-taking.

Oil prices have been volatile, trading within a $73–$75 range and experiencing a sharp pullback after briefly touching new weekly highs at $75.70.

Equity indices are sending mixed signals. Major U.S. indices ended the day flat, with the exception of the Russell 2000, which closed up 0.55%.

In contrast, European markets mirrored that move in reverse, finishing down by roughly the same margin. Japan’s Nikkei stood out with a 1.08% rally.

Gold seems to have found a local top, now logging its second consecutive daily decline. An update will be coming up to breach the gap between the anxious markets and a lackluster performance from Safe-Haven assets.

Other industrial metals are showing mixed performances with Copper up 1% and SIlver down about a similar amount.

One standout performer on the commodities front was Wheat, which surged over 4.2% after Russia declared a drought emergency, triggering fresh supply concerns.

Daily Cross-Asset performance

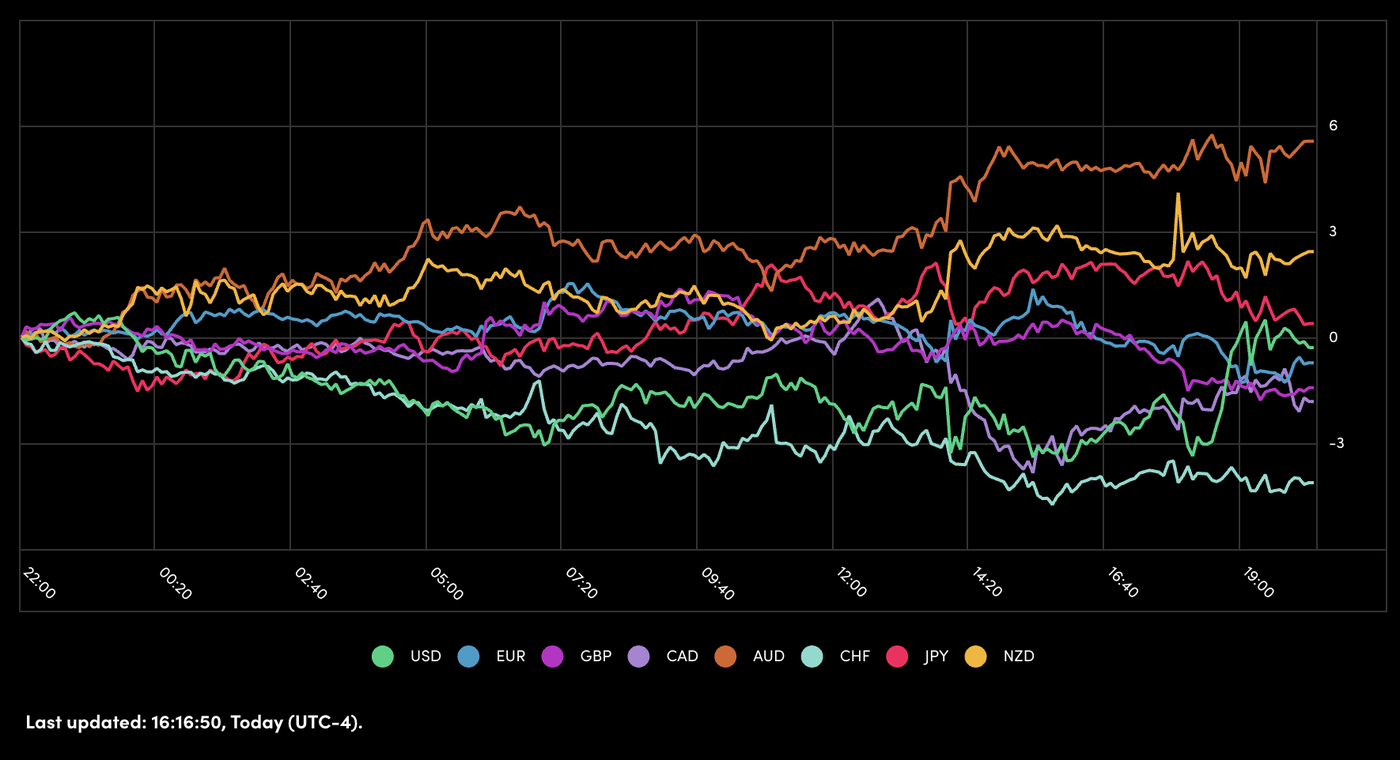

A picture of today’s performance for major currencies

APAC Currencies are the clear leaders of the day, in what is starting to be a trend of strong performance for both the AUD and NZD.

The distance from the Middle-Eastern conflict and US-China trade tensions abating in the past few weeks are fundamental contributors to this outperformance, supplemented by lesser cut expected particularly by the RBNZ.

CHF was the worst performer of the day as markets are selling off their safe-havens with Equity markets coming back. The risk premium is one that the market is ready to pay these days.

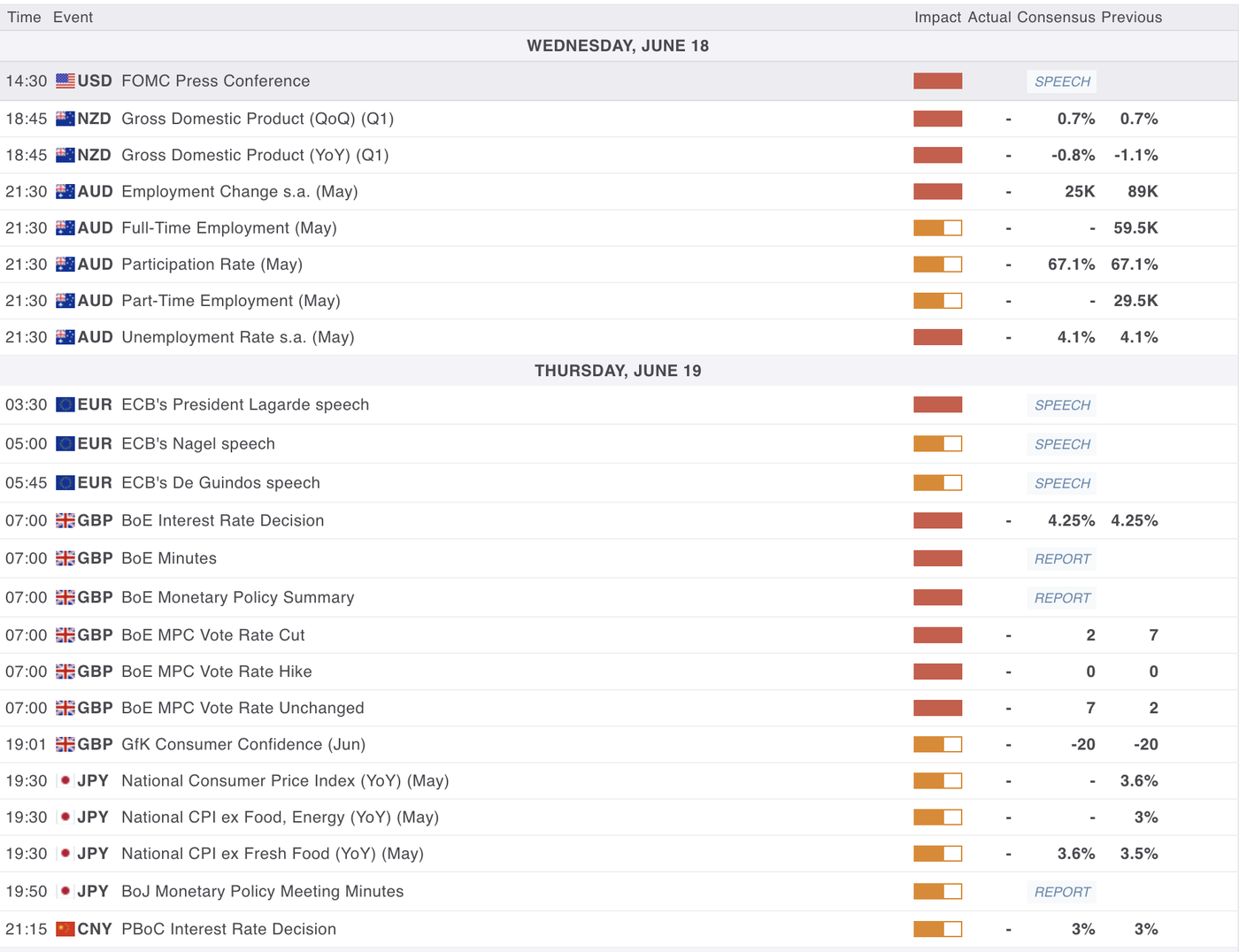

A look at the Economic Calendar for tomorrow’s session

Tomorrow’s session will be another session full of economic data releases, spread throughout the entire session.

Starting in the overnight session, we will see the release of Employment Change statistics from Australia (expected at 25K), releasing at 21:30 E.T. tonight.

ECB’s President Lagarde will be speaking at 3:30 A.M. in Kiev, Ukraine. She should not speak much about Monetary Policy but some decent info could be taken from her speech.

The Bank of England Rate Decision is expected at 7:00 tomorrow with no cuts priced in the market – The BoE has surprised before, therefore always take precautions.

Finally, tomorrow evening will see the release of Japan’s inflation data (19:30) and the BoJ Minutes, shortly followed by the Chinese PBoC Rate Decision at 21:15

Safe Trades!

Opinions are the authors’; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2025 OANDA Business Information & Services Inc.