Markets started off steady but turned shaky as central bank decisions and Middle East tensions shook risk appetite.

Stocks tumbled, oil spiked, gold wobbled near its lows, and the dollar danced between safe-haven demand and rate hike speculations.

Here are headlines you may have missed in the last trading sessions!

Headlines:

- WSJ: Trump privately approved attack plans for Iran but has withheld final order

- New Zealand GDP for Q1 2025: 0.8% q/q (0.7% forecast, 0.5% previous)

- Australia employment change for May: -2.5k (15.0k forecast; 89.0k previous); unemployment rate held at 4.1% vs. 4.1% forecast/previous

- Australian funds cut US Treasury holdings on Trump policy risks

- Swiss balance of trade for May: 2.0B (5.5B forecast; 6.3B previous)

- SNB report: Swiss financial stability under pressure amid global trade tensions

- Swiss National Bank interest rate decision for June: 0.0% (0.0% forecast; 0.25% previous)

- SNB Chairman Schlegel acknowledged they’re on the “verge of negative terrritory” on rates, with Bank “willing to be active in the foreign exchange market as necessary”

- BOE Holds Rates at 4.25% But Dovish Split Hints at August Cut

- BOE member Lombardelli said the U.K.’s services price inflation “remains sticky” despite a decline in May

- Norges Bank, the central bank of Norway, surprised economists by reducing its key deposit rate by a quarter point to 4.25%

- Euro area construction output for April: 3.0% y/y (-1.6% forecast y/y; -1.1% y/y previous)

- Israel-Iran conflict escalated with a big Israeli hospital hit by Iranian missile strike

- Canada CFIB business barometer for June: 47.3 (43.0 forecast; 40.0 previous)

- Trump said there’s a “substantial chance of negotiations” with Iran, will decide on U.S. participation “within the next two weeks”

Broad Market Price Action:

Markets opened with cautious optimism before volatility spiked once traders had to juggle a flood of central bank decisions and rising tensions in the Middle East. European stocks took the brunt of it, with the DAX dropping 1.14% and the CAC 40 sliding 1.34%, as concerns grew over supply disruptions and economic fallout from the escalating Iran-Israel conflict.

US equity futures had a rough start and couldn’t quite find their footing. By the end of the session, they logged modest losses as traders tried to balance the Fed’s hawkish messaging with safe-haven flows sparked by talk of possible U.S. military strikes on Iran.

Gold stayed pinned near its recent lows, even with all the geopolitical noise. The Fed’s push for steady rates continued to outweigh gold’s usual safe-haven appeal. Bitcoin held up a bit better, only dipping to $104,680, thanks to steady institutional demand despite the shaky backdrop.

WTI crude oil advanced to around $75.50 per barrel, benefiting from supply disruption fears and the geopolitical premium embedded in energy markets, before dropping to $73.80 around the London close.

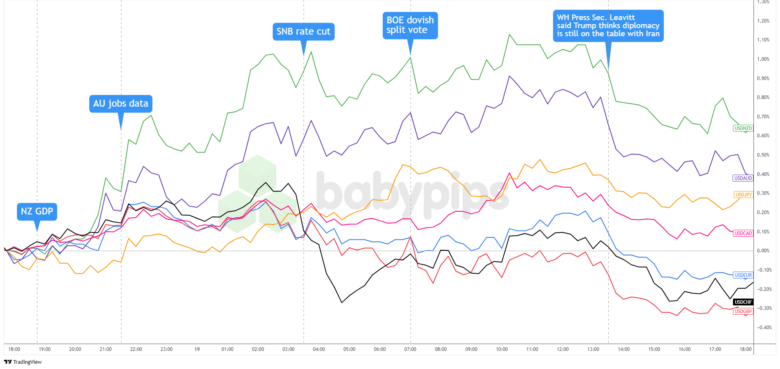

FX Market Behavior: U.S. Dollar vs. Majors:

The U.S. dollar traded mixed as traders weighed central bank surprises against shifting geopolitical sentiment.

The Greenback edged higher in Asia, possibly as traders digested the Fed’s less dovish tone. Markets priced in fewer rate cuts and a more restrictive policy stance, giving the dollar a modest lift across the board.

Dollar strength extended into the European session but began to wobble after the Swiss National Bank surprised with a cut to 0.00%, and Chairman Schlegel hinted they weren’t ruling out negative rates. This dovish pivot gave USD/CHF an extra push. At the same time, the British pound briefly slipped after the Bank of England revealed a 6–3 vote, with growing speculation that an August cut may be in play.

By the start of the U.S. session, the dollar held steady, but sentiment shifted around the London close after White House Press Secretary Leavitt signaled that President Trump remained open to diplomacy with Iran. The remark helped ease geopolitical concerns and dialed back safe-haven demand.

By the end of the trading day, the dollar closed mixed. It posted gains against the yen and the comdolls, but slipped against the European currencies.

Upcoming Potential Catalysts on the Economic Calendar

- Germany PPI for May at 6:00 am GMT

- U.K. retail sales for May at 6:00 am GMT

- U.K. public sector net borrowing ex banks for May at 6:00 am GMT

- France business confidence for June at 6:45 am GMT

- Swiss current account for March 31 at 8:00 am GMT

- Canada producer price index growth rate for May at 12:30 pm GMT

- Canada new housing price index for May at 12:30 pm GMT

- Canada retail sales prelim for May at 12:30 pm GMT

- Canada raw materials prices for May at 12:30 pm GMT

- Philadelphia Fed manufacturing index for June at 12:30 pm GMT

- Euro area consumer confidence flash for June at 2:00 pm GMT

- U.S. CB leading index MoM for May at 2:00 pm GMT

- U.S. Fed balance sheet for June 18 at 8:30 pm GMT

Traders in the European session should watch for U.K. retail sales and German inflation data, which could move the British pound and euro if they come in stronger or weaker than expected.

In the U.S. session, Canadian inflation and spending figures plus the Philly Fed index may shake up CAD and USD pairs as markets gauge how the North American economies are holding up.

As always, stay nimble and don’t forget to check out our Forex Correlation Calculator when taking any trades!