The Dow Jones has escaped some bearish outlooks having found some support close to the 44,000 handle.

American markets have had some rough headwinds hurting their outlooks, between some newfound geopolitical turmoil (Middle East, Russia and Ukraine), the usual tariff micmac, and even more importantly, the compromising of the Federal Reserve’s independence.

Progressively, Markets are seeing some signs of bearish catalysts dissipating but the sky is still grey – Deals are starting to work out (Trump mentions progress with EU Deal, still work to do with Canada) and the US President finally mentioned the importance of him not firing Jerome Powell for Market stability.

The ongoing Earnings season hasn’t disappointed

with US Banks seeing some very decent reports, Johnson and Johnson has seen the worst major US Company reports but the rest hasn’t disturbed markets the least.

This morning saw the release of some Key US Data in better than expected Jobless Claims, and even more market-moving retail sales which have surprised to the upside.

You can take a look at our latest report on the morning releases right here.

Let’s take a look at intraday, shorter timeframes Dow Charts to spot an edge on the ongoing trends.

Dow Jones intraday update

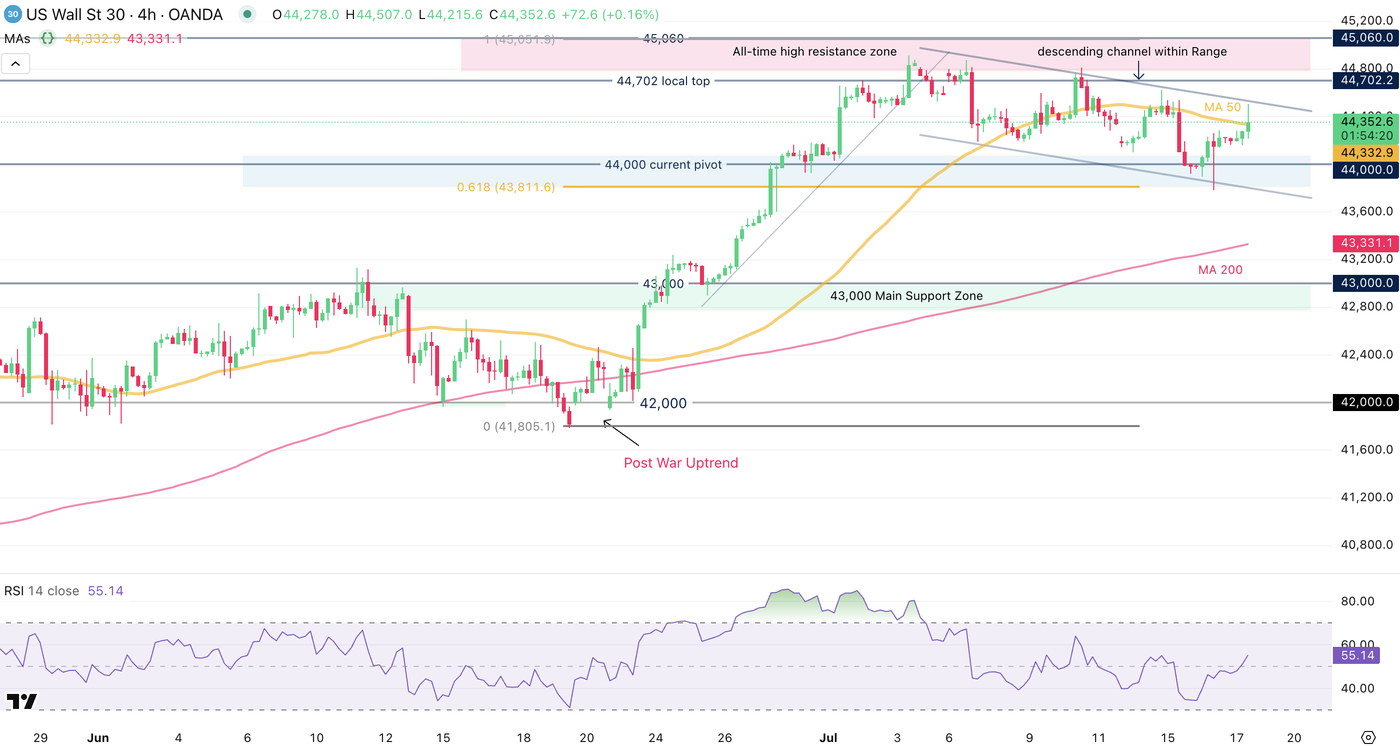

US 30 4H Chart

The Dow escaped some bearish headwinds, breaking several upwards trendlines and failing to reach new all-time highs (compared to the S&P 500 and Nasdaq which are still trading above Early 2025 ATHs).

Despite some concerns, buyers have held the index above 44,000, a Key Pivot for technical sentiment – Some wicks after Market volatility did reach all the way down to 43,700 before reverting swiftly. Better than expected US Data has led to some decent recovery.

The action is currently rangebound and RSI Momentum is neutral but tilting higher.

This morning’s Retail Sales report has created some upwards movement which got stalled at the upper bound of the ongoing descending channel, with the 4H 50-period MA holding buying momentum – Buyers might try to get the upper hand though, so let’s take a look closer.

US 30 1H Chart

Looking at the 1H Timeframe allows us to take a closer look to the ongoing 44,000 to 44,700 Range that the Index has been holding.

A descending Channel has been into play which will buyers will have to break higher (in confluence with the 1H MA 200) to avoid the lower high trends playing right now.

Price action from the past 24 hours haven’t been bearish however, with the deep wick from yesterday’s war headlines that marked some temporary refusal to head lower despite the headwinds.

US 30 ongoing session – 10M Chart

Observe the details of all the key events and their market reactions on the chart.

Watch the ongoing consolidation at the top of the hourly downwards channel.

A rejection of this zone will pursue the ongoing corrective sequence.

On the other hand, breaking upwards will lead to further rangebound action whcih would be more bullish looking at other indices and the past months of upwards momentum.

Right now, buyers are holding the upper hand with them needing to hold the steep upwards momentum trendline to try to break this morning session’s 44,500 highs.Safe Trades!

Opinions are the authors’; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2025 OANDA Business Information & Services Inc.