This article is a follow up to the GBP/USD article posted on July 15, titled GBP/USD Vulnerable as Trendline Break Sets Up Potential 600 Pip Drop

GBPUSD has continued its recovery having dipped below a long term ascending trendline discussed in the July 15 article. Not a complete surprise given that the pair was in oversold territory on the daily chart and I did mention the possibility of a pullback.

It Begs the Question, What Has Changed for the British Pound?

The pullback which took place following the highs printed on July 1 were largely driven by developments in the UK, with fiscal concerns coming to the fore and renewed dovishness from the Bank of England.

This week’s UK data has strengthened the case for fewer rate cuts, thanks to stronger-than-expected inflation (CPI) and solid labor market numbers.

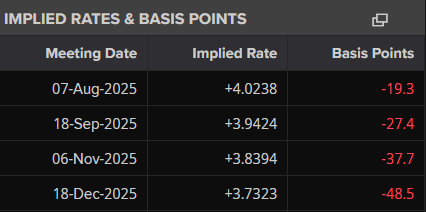

However, this was not enough to alter rate cut expectations ahead of the next Bank of England (BoE) meeting on August 7. Markets are still expecting almost one full 25 basis point rate cut and a total of nearly 50 basis points of easing by December, based on LSEG data.

Implied BoE Rate Cuts Through December 2025

Technical Analysis – GBP/USD

GBP/USD has tested the descending trendline on the four-hour chart and so far it has failed to break above the trendline.

A break of the trendline could lead to an extended rally to the upside with potential targets and resistance around 1.3585 which is also where the 100-day MA rests.

Should such a move occur it would not necessarily invalidate the bearish long-term setup on the daily discussed in the July 15 article.

GBP/USD Four-Hour Chart, July 18, 2025

The Daily chart below as you can see is also showing the trendline retest and immediate resistance at 1.3500.

A deeper retracement toward the 1.36570 may still be a possibility based on the daily timeframe with only a daily candle close above this level invalidating the long-term bearish setup discussed in GBP/USD Vulnerable as Trendline Break Sets Up Potential 600 Pip Drop, written on July 15.

A pullback to this level could provide market participants with a better risk-to-reward opportunity.

GBP/USD Daily Chart, July 18, 2025

Support

- 1.3438

- 1.3380

- 1.3250

Resistance

- 1.3500

- 1.3657

- 1.3788

Client Sentiment Data – GBP/USD

Looking at OANDA client sentiment data and market participants are MIXED on the GBPUSD with just 52% of traders net-short. I prefer to take a contrarian view toward crowd sentiment and usually prefer atleast a 60/40 split between Net Long and Short. This is just a sign of the indecision and concern around GBP/USD. Will we see a deeper pullback before the next leg lower or is this the next leg higher to print fresh highs? This question is no doubt weighing on the minds of market participants.

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Opinions are the authors’; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© 2025 OANDA Business Information & Services Inc.