BTC/USD–

EUR/USD–

GBP/USD–

NZD/USD–

USD/CAD–

USD/CHF–

USD/JPY–

XAU/USD–

-1.0-0.50.00.51.0

AUD/USD–

EUR/USD–

GBP/USD–

NZD/USD–

USD/CAD–

USD/CHF–

USD/JPY–

XAU/USD–

-1.0-0.50.00.51.0

AUD/USD–

BTC/USD–

GBP/USD–

NZD/USD–

USD/CAD–

USD/CHF–

USD/JPY–

XAU/USD–

-1.0-0.50.00.51.0

AUD/USD–

BTC/USD–

EUR/USD–

NZD/USD–

USD/CAD–

USD/CHF–

USD/JPY–

XAU/USD–

-1.0-0.50.00.51.0

AUD/USD–

BTC/USD–

EUR/USD–

GBP/USD–

USD/CAD–

USD/CHF–

USD/JPY–

XAU/USD–

-1.0-0.50.00.51.0

AUD/USD–

BTC/USD–

EUR/USD–

GBP/USD–

NZD/USD–

USD/CHF–

USD/JPY–

XAU/USD–

-1.0-0.50.00.51.0

AUD/USD–

BTC/USD–

EUR/USD–

GBP/USD–

NZD/USD–

USD/CAD–

USD/JPY–

XAU/USD–

-1.0-0.50.00.51.0

AUD/USD–

BTC/USD–

EUR/USD–

GBP/USD–

NZD/USD–

USD/CAD–

USD/CHF–

XAU/USD–

-1.0-0.50.00.51.0

AUD/USD–

BTC/USD–

EUR/USD–

GBP/USD–

NZD/USD–

USD/CAD–

USD/CHF–

USD/JPY–

-1.0-0.50.00.51.0

What is Currency Correlation?

Currency correlation measures how closely the price movements of two different currency pairs are connected. It indicates whether currencies tend to move in the same direction, in opposite directions, or with no discernible pattern.

If you’re a beginner in trading and plan to trade multiple currency pairs simultaneously, it’s crucial to understand the relationships and movements between these pairs.

What are the types of correlation?

- Positive correlation: Two currency pairs move in the same direction. For example, if EUR/USD goes up, GBP/USD might also go up.

- Negative correlation: Two currency pairs move in opposite directions. For example, if EUR/USD goes up, USD/CHF might go down.

- No correlation: The movement of the currency pairs is random and has no apparent connection.

How is correlation measured?

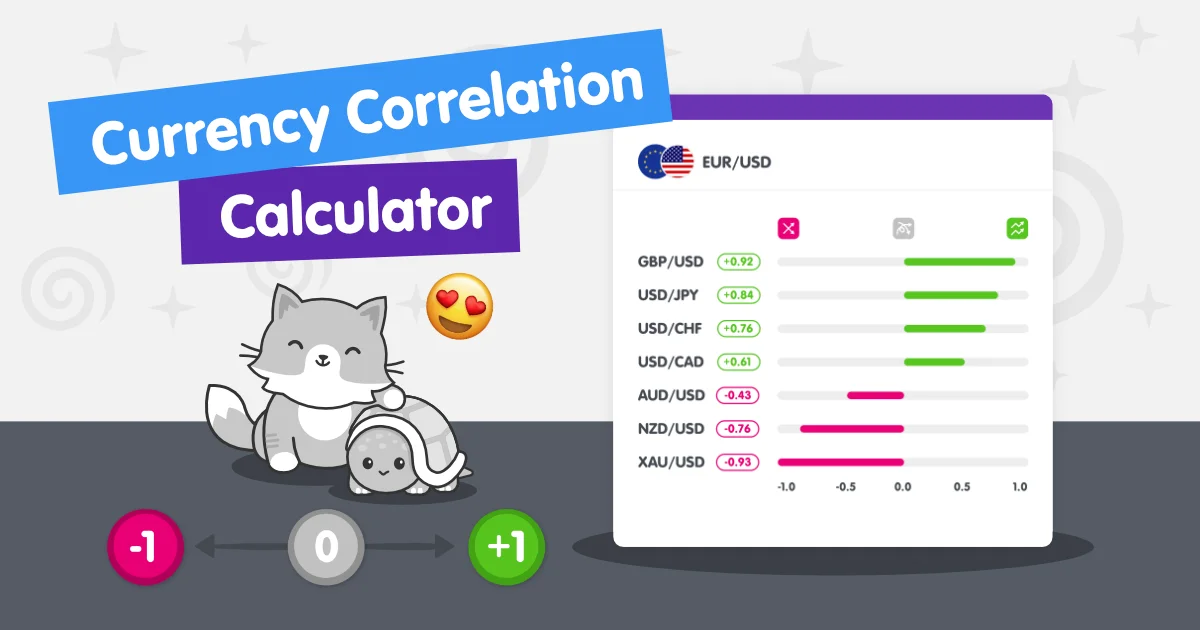

Correlation is typically measured on a scale of -1 to +1, known as the correlation coefficient.

A correlation coefficient of +1 shows that two currency pairs will move in the same direction 100% of the time. They have a perfect positive correlation.

A correlation coefficient of -1 indicates that two currency pairs will move in the opposite direction 100% of the time. They have a perfect negative correlation.

A correlation coefficient of zero indicates that the movement of the currency pairs is random and there’s no predictable relationship between them. They have no correlation.

Why is currency correlation important for forex traders?

Understanding currency correlation helps you:

- Reduce risk: Choose currency pairs with low or negative correlations to reduce overall risk. If one pair loses value, the other might gain value or remain stable.

- Avoid overexposure: If you have several trades open on highly correlated pairs, a market event could significantly impact your entire trading book in the same way.

- Identify trade opportunities: If one currency pair in a positive correlation is showing a strong trend, the other pair might provide a similar opportunity.

- Hedge: Opening trades on negatively correlated pairs can “hedge” or offset potential losses from other trades.

Can you give me an example of why I should care about currency correlation?

Understanding the relationships between different currency pairs is crucial if you trade more than one pair at the same time.

Let’s say you go long two currency pairs that move in the same way such as EUR/USD and GBP/USD. If the market shifts unfavorably, you could lose money on both trades instead of just one.

On the other hand, if you take a short position in EUR/USD and a long position in GBP/USD, the risks in each trade may partially cancel out because these two currency pairs often move together, showing a positive correlation. You may not lose money, but you won’t make money either.

Understanding correlation helps you make smarter choices to manage your risk.

What factors influence currency correlation?

- Economic ties: Countries with strong trade relationships or similar economic policies often have correlated currencies.

- Shared currencies: Currencies that share a base or quote currency (e.g., EUR/USD and EUR/JPY) are naturally more correlated.

- Risk sentiment: During times of market uncertainty, investors may flock to “safe haven” currencies like the U.S. dollar or the Japanese yen, creating correlations across different pairs.

Important Notes:

-

Correlations can change over time.

Changes in risk sentiment, economic conditions, monetary policy, fiscal policy, and geopolitical events can strengthen or weaken correlations. Always check up-to-date correlation data.

-

Correlation isn’t causation.

Just because two pairs move together frequently doesn’t mean one causes the other’s movement. There are often complex economic factors involved.

-

Financial markets are complex systems influenced by numerous factors.

Financial markets often involve entangled relationships between different assets. A change in one asset’s price can trigger a cascade of reactions in other assets, making it difficult to isolate a single cause-and-effect relationship.